Take-Two Interactive CEO Strauss Zelnick has expressed his stance on how entertainment, specifically video games, should be priced, a contentious topic at the best of times. According to the executive's philosophy, this can be calculated by a seemingly simple algorithm, though its nebulous nature makes its efficacy unclear.

During the company's Q2 2024 earnings call (thanks, eXputer), Zelnick was asked about increasing subscription service prices across the larger media landscape. The executive responded to the question but noted that it has "nothing to do with our business", then outlined his position on how much value consumers get for the price they pay for games, stating that:

"In terms of pricing for any entertainment property, basically the algorithm is the value of the expected entertainment usage, which is to say that the per-hour value times the number of expected hours plus the terminal value that's perceived by the customer in ownership if the title is actually owned, not, say, rented or subscribed to. And you'll see that that bears out in every kind of entertainment vehicle. By that standard, our frontline prices are still very, very low because we offer many hours of engagement."

We had to read that one several times, but helpfully, Zelnick clarifies: "The value of the engagement is very high. So, I think the industry, as a whole, offers a terrific price-to-value opportunity for consumers. That doesn't necessarily mean that the industry has pricing power or wants to have pricing power. However, there is a great deal of value offered."

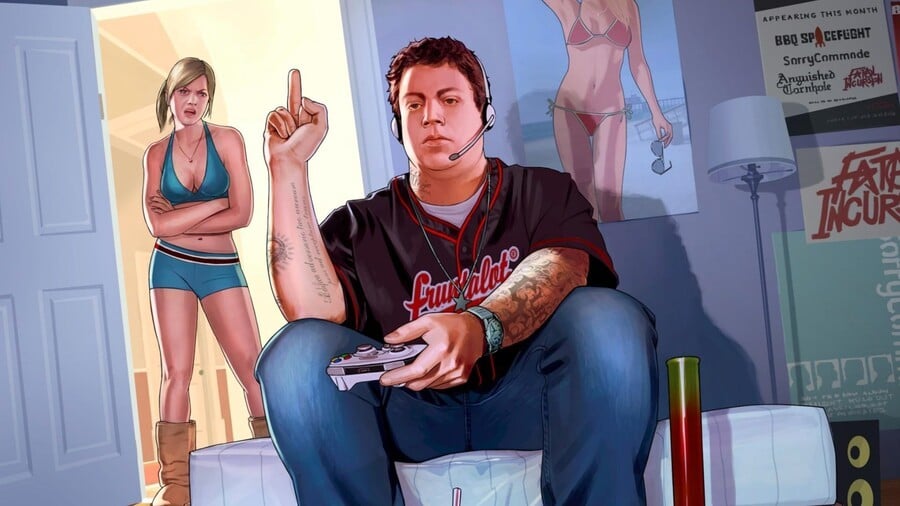

To our mind, what Zelnick seems to be getting at is the perceived value of owning a title like the next Grand Theft Auto is greater, proportionally, to a customer based on how eagerly they anticipate it and how deeply they engage with it after release. By that metric, we can see his point and even agree to a certain extent. For example, we've put hundreds of hours into Civilization VI, which came to PS4 in 2019 and can essentially be replayed endlessly. If we knew that would be the case, paying more upfront wouldn't seem so onerous, but therein lies the problem.

Zelnick closes with some final thoughts: "It's our strategy here to deliver much more value than what we charge consumers. There have been precious few price increases in the business. The price increase, for example, the $70 for certain frontline products, was the first increase in many years after many generations. So again, I think we offer a terrific value to consumers."